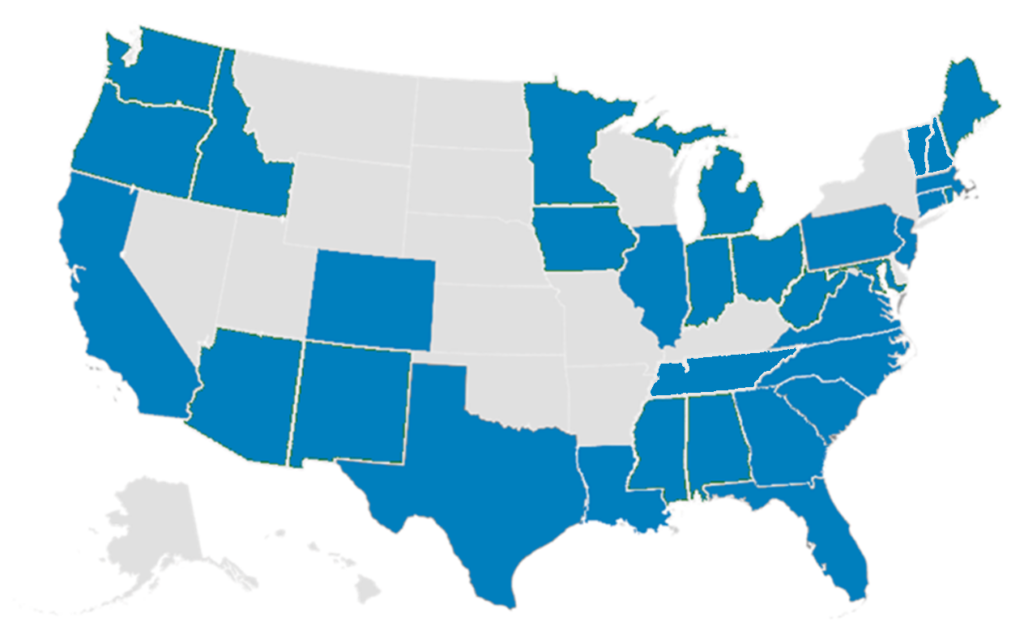

Product Availability Map

- Flexible Payment Plans

- Lender Accepted

- Risk Assessment Before Purchase

- No Elevation Certificate Required

- Little or No Waiting Period

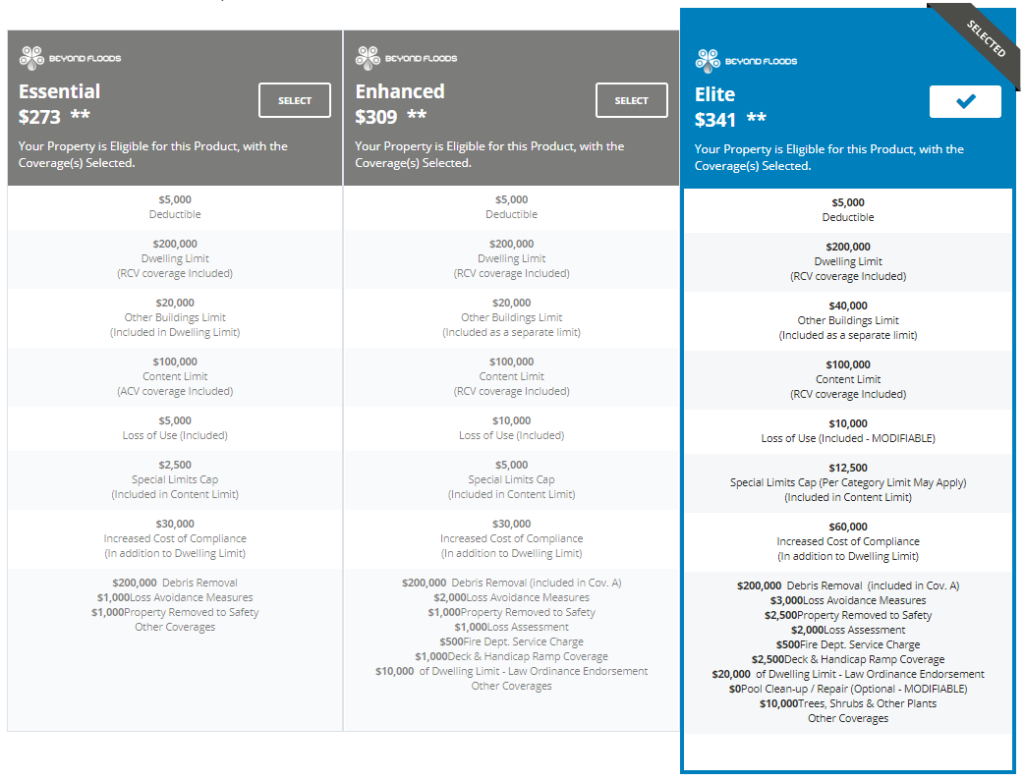

Simplified Flood Insurance

- Up to $1.5m Building Coverage

- Full Replacement Value for Damages

- Living Expenses if Displaced

- Basement Coverage Available

Customize For Your Needs

Register Today to Become our Agent